Collecting Debt from Owners in Arrears under the Sectional Titles Schemes Management Act 8 of 2011

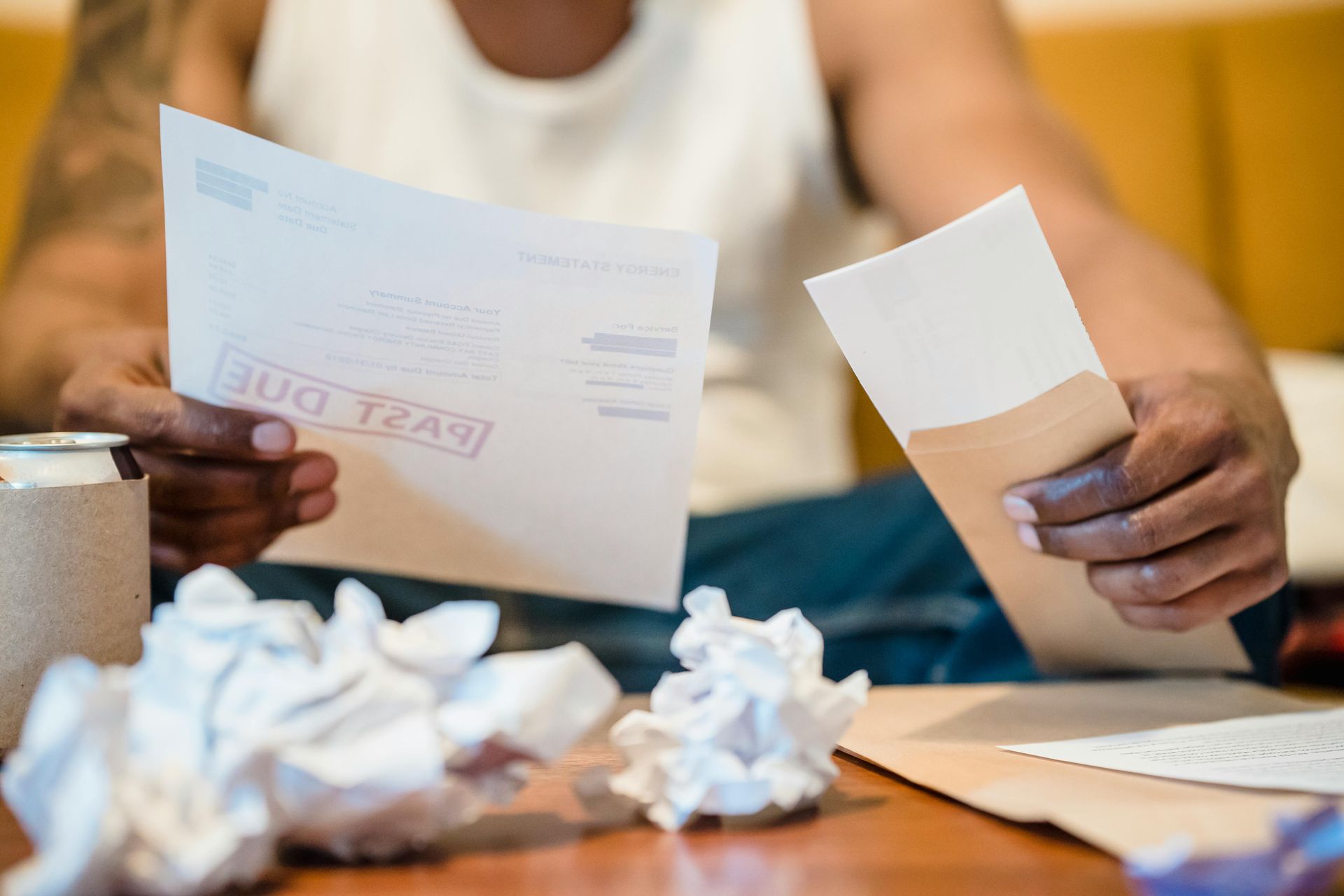

The management of sectional title schemes in South Africa is governed by the Sectional Titles Schemes Management Act 8 of 2011 (STSMA). One of the critical responsibilities of the body corporate under this Act is to ensure the collection of levies and contributions from unit owners. When owners fall into arrears, it can significantly impact the financial health of the scheme, making efficient debt collection processes essential.

Legal Framework for Debt Collection

The STSMA and its regulations provide a structured approach for levies and debt collection. Section 3 of the Act mandates that the body corporate must establish and maintain a reserve fund and an administrative fund, which are funded by contributions from owners. When an owner fails to pay their levies, the body corporate has legal recourse to recover the debt.

Steps to Collect Debt from Owners in Arrears

1. Issue a Written Demand

The first step in the debt recovery process is to send a formal written demand to the defaulting owner. This demand should:

- Specify the outstanding amount.

- Provide a due date for settlement.

- Outline any applicable interest and penalties.

- Inform the owner of further legal action if the debt remains unpaid.

2. Apply Interest and Penalties

The body corporate may impose interest on overdue levies, provided such interest is authorized by the scheme’s conduct rules and is in accordance with the prescribed rates set out by the Community Schemes Ombud Service (CSOS).

3. Engage in Negotiation or Mediation

If the owner disputes the debt or is unable to pay in full, the trustees may consider negotiating a payment plan. Mediation through CSOS may also be an effective way to resolve disputes before escalating legal action.

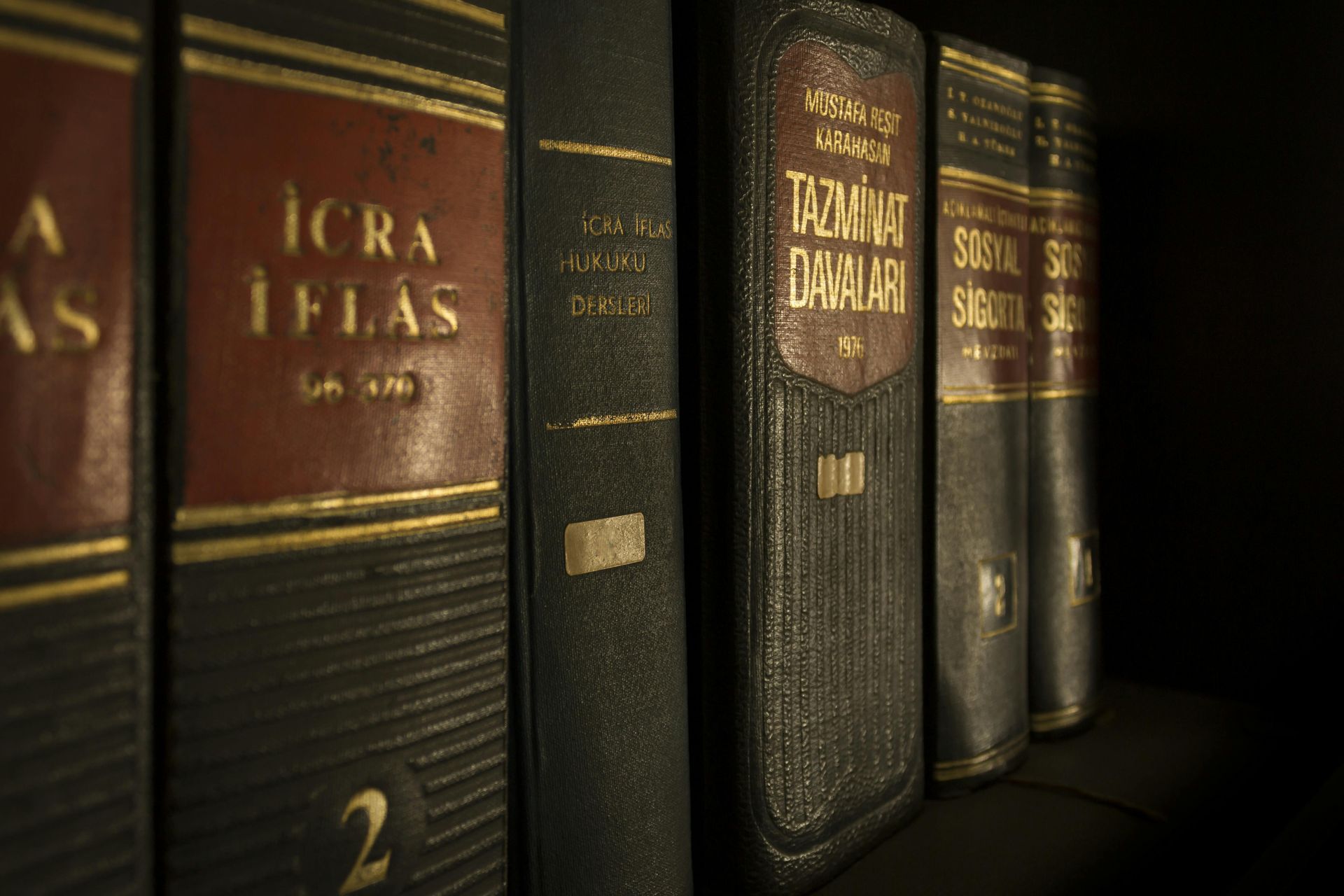

4. Obtain a Court Order or CSOS Order

If the debt remains unpaid despite previous steps, the body corporate can:

- Apply to CSOS for a debt recovery order.

- Approach the Magistrate’s or High Court for a judgment against the defaulting owner.

Once a judgment is obtained, the body corporate may proceed with enforcement actions, such as:

- Attaching the debtor’s movable property.

- Garnishee orders on income.

- Selling the unit in execution to recover outstanding debts.

5. Legal Eviction and Forced Sale

In extreme cases where an owner persistently defaults and fails to comply with legal recovery actions, the body corporate may apply for a court order to sell the unit in execution. The proceeds from the sale are then used to settle outstanding debts.

Preventative Measures to Reduce Arrears

To avoid high levels of debt accumulation, sectional title schemes should implement proactive measures, including:

- Regular communication with owners regarding levy obligations.

- Enforcing a strict levy payment policy.

- Conducting thorough financial planning to maintain adequate reserve funds.

- Encouraging early intervention when owners experience financial difficulties.

Conclusion

The STSMA provides a clear framework for collecting levies and managing arrears in sectional title schemes. By following due process and utilizing legal remedies, bodies corporate can ensure financial sustainability while maintaining fair and effective management of sectional title properties. Proactive measures, combined with legal recourse, will help safeguard the scheme's financial health and prevent future arrears issues.